Let’s briefly recap Part 1, and Part 2 of this short series.

- Being poor is expensive – forced to buy inferior goods, pay higher financial rates & rely on state subsidies

- Being poor can be generational – once in the Poverty Trap it’s very hard to escape

- The poverty trap helps keep people in subsistence living, subsidised by the state, funded by tax payers

- The income / wealth divide continues to grow despite state subsidies increasing

- Quantitative Easing and debt based money creates asset and price inflation / fiscal drag over time

- We only have a debt based monetary system because Governments lie and defraud us

The Cantillon School of Economics

“The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.”

Terry Pratchett – Men At Arms

Sam Vimes isn’t wrong in his basic assumption about the economics of Ankh-Morpork, but it doesn’t reflect our own reality. In the Discworld novels, the money wasn’t controlled by a singular central bank, but by many private banks issuing currency. This currency was backed by or exchangeable for gold and other precious metals, similar to how our global monetary systems worked prior to the 1900’s.

In our world, the governments and the wealthy benefit through seigniorage. Seigniorage is the difference between the face value of the money in question, and the actual cost of producing it. A gold coin may have a face value, but the purchasing power of that coin will fluctuate with the amount of gold in circulation. If demand for goods and services is constant, the more gold in the economy, the less it’s worth = inflation (bearing in mind that the opposite is true as well = deflation). When we, as a global market, pivoted from a Gold based system to a credit based system (also known as fiat money), we reduced the cost of producing our money to the cost of minting coins and paper notes regardless of their face value. Now that we have digital based money the cost of producing our money is essentially zero. If supply of the money goes up faster than demand for the money (GDP growth), then your money buys less.

For a government to produce more fiat money to spend, it costs them nothing. We also have to be aware that banks have this power as well through a Banking License. When you take out a loan, mortgage, or spend on a credit card, you are not “borrowing” money. The bank creates new money to credit you (an asset for them, a liability for you) and when you pay this back, the money is deleted from the ledger. The interest that you paid them over that period remains in the system, forever expanding the monetary supply, this is usury.

We can also reference something known as the Cantillon Effect. The expansion and contraction of the Money supply is uneven and the impact disproportionate; something that was observed by Richard Cantillon, a French economist from the 18th Century. When new money enters the economy (through central bank QE, government spending, or deficit financing) it does not enter the economy evenly. Instead, it tends to flow first to those who are closest to the source of the new money, such as banks and government contractors. From there, it flows to those who have good ‘credit’ and receive preferential lending rates, sometimes borrowing against other assets they already own.

These early recipients of the new money can then use it to purchase assets, goods and services before prices have had a chance to fully adjust. As a result, they benefit from lower prices and increased purchasing power. However, those who receive the new money later, such as workers and consumers, must pay higher prices for the same goods and services. This is because prices have already begun to rise in response to the increase in the money supply.

Because we have demonetised money (gold) we have incentivised the storing of wealth in assets (real estate / wine / stocks / jewelry). As the purchasing power of our money goes down over time, the perceived value of these assets continues to increase. Due to the Cantillon effect combined with fiscal drag we have the situation whereby we are raising a generation that may never be able to afford to preserve their wealth, but are forever feeding it upwards. We broke the commodity money, skewed the time preference of modern society, and created an exponential debt cycle.

- Gold Standard – Commodity > Money > Commodity

- Fiat Standard – Money > Commodity > Money

The Cantillon effect can have a significant impact on wealth distribution and inequality. Those who are first to receive the new money tend to become wealthier, while those who receive it later tend to become poorer. This can exacerbate existing economic disparities and make it more difficult for people to move up the economic ladder. This effect has been going on since the Governments and Banks decided it was in their own best interest to generate money from thin air.

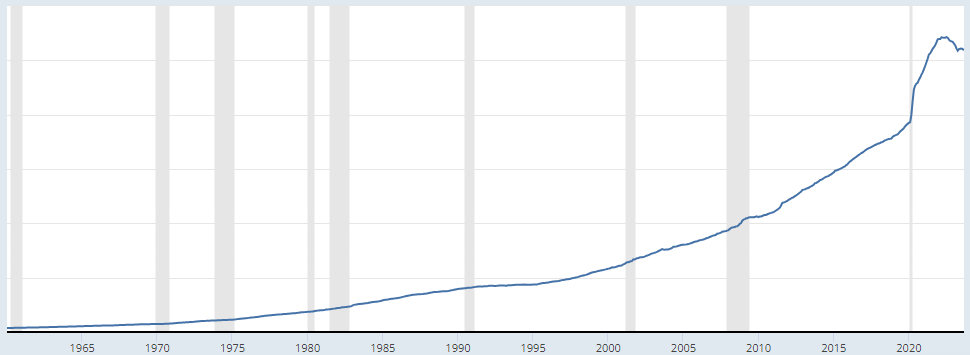

Monetary Aggregates and Their Components: Broad Money and Components: M3 for United States

Personal Responsibility

“If you think that by doing nothing, you will achieve nothing, then you are right.”

Terry Pratchett, Guards! Guards!

I hope by now you have a broad understanding of how our monetary system works. Creating a money that has zero cost of production broke the cycle that allowed wealth to distribute down and out. Instead creating an up-only momentum to the concentration of both wealth and power. The closer you are to the source of the money, the greater the benefits of an inflationary money, the further away, the greater the downside impact. The more money you have, the more preferential access you have to opportunities to expand your wealth. The more opportunities you have the better you can leverage that into more wealth creation. This is exponential.

I will make this statement as clear as possible for people who have been laboring under any misconceptions (as I had) for most of their adult life:

- We have demonetised money, and created a system that rewards the monetisation of assets

- The cost of creating money, for the government and banks, is essentially zero

- The cost of creating money for ourselves is time and energy

- Artificial demand for fiat currency is created through taxation and legal tender laws

- The more money they create, the faster it concentrates at the top of society

- The closer you are to the top of society the easier it is to create more wealth

- The best wealth creating enterprises are exclusive to the already wealthy

How does a person protect themselves from a system designed specifically to separate the majority from the fruits of their labors and give it to the minority? The first step is being aware of how the system works, understanding that it is indeed designed against your favor, and I hope we have covered these broad strokes concepts. The second is in figuring out how best to preserve your own production output, the fruits of your labor. This is a tricky game to play. Understanding that the closer you get to the source of money does not make the act of getting closer any easier, but we can understand the mechanics of wealth preservation.

- Holding cash balances over the long term is generally a net negative as it loses purchasing power

- Assets that tend to appreciate value over time are a good store of value

- The scarcer the asset with consistent demand, the better the store of value

- The more debt you have the longer it will take to accumulate any savings

- There’s no such thing as getting rich quick without massive risk, or such thing as guaranteed returns

So the recipe should be simple. Be mindful of your spending habits, invest in yourself to increase your productivity, build relationships with others of the same mindset, delay unnecessary purchases adopting a low time preference, save regularly, avoid predatory financial products and services, be wary of anything that promises outsized returns, be skeptical of investment advice from those you don’t know or trust, and have patience.

Conclusion

Actually, I’m going to break most of that advice and keep it very simple. The easiest way to side-step the negative effects of our current monetary system is to opt out of it as much as possible.

You should have some allocation to Bitcoin in any fiscally responsible forward planning. It is riskier at this point to not have an allocation now, given potential upside, than it is to not have any at all. For the following reasons. The supply is measurable and definably finite (21 million coins). There is zero financial barrier to entry other than access to a computer or mobile phone. No one person or group can create more of it than is designed by the programming, and no faster than the production mechanism allows. Demand, as with any network effect technology that thrives on adoption, should continue to increase. Through awareness, decreases in price volatility and as traditional portfolio structures adjust to a shifting, more inflationary world.

It’s also the first monetised global asset, that through self-custody, that we can store in our heads by remembering the randomised combination of 12 secret words giving us access to our Bitcoin. Sounds a little bit like magic.

I give no forward price prediction, this is not investment advice, this is reading advice. Learn about Bitcoin.

https://bitcoin.org/en/how-it-works